|

Good morning! Welcome back to the Canadian Fintech Newsletter, an industry roundup for founders, operators and investors.

Every Monday we break down the hottest topics in the industry in under 3 minutes.

If you’re a paid subscriber, you also get access to the Canadian Fintech Database - a detailed list of every fintech acquisition in Canada.

Mark your calendars:

Oct 20th is the Canadian Lenders Summit. Expect hundreds of banks & fintechs.

Oct 26-29th is Money2020 in Vegas. Apply here to join the Canada Delegation. I’m leading it and you’ll receive a discount.

Was this forwarded to you? Become one of our 13,267 subscribers by clicking below.

💰 Funding

TransCrypts, a Toronto based tool for employee verification and background checks, raised $20m from Pantera and Marc Cuban.

Spellbook, a Toronto based tool for lawyers to draft and analyze contracts raised USD $50m at a $350m valuation led by Khosla Ventures.

The founders of 1Password, a Toronto based secure sign-in platform sold a $100m stake to the Utah Jazz owner’s VC fund.

1Password has raised over $1b and made four acquisitions.

🤝 M&A

Dye & Durham, the embattled compliance and data firm, is selling off Credas Technologies, a UK based identity verification service for $146m.

TMX Group, which owns Canada’s main stock exchanges, is acquiring Verity, a US based investment research platform.

Last year they acquired Newsfile, a press release platform.

Vancity, Canada’s 2nd largest credit union, received approval to merger with fellow BC credit union First CU.

Valsoft, a Montreal based private equity firm focused on small, niche software businesses acquired CORE Cashless, a US based payment processor focused on theme parks.

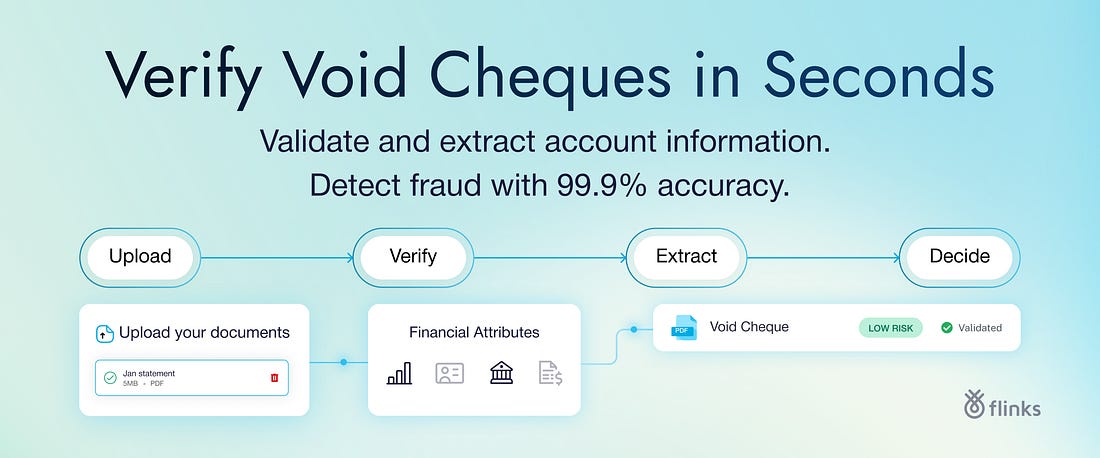

A MESSAGE FROM FLINKS

💸 Void cheques verified instantly. Fraud detected automatically.

Borrowers expect speed. Fraudsters count on your blind spots.

Flinks Upload delivers both: authenticating void cheques and bank statements in real time. Trained on 100M+ documents, Flinks detects up to 3× more fraud and confirms account ownership instantly.

Lenders cut days off onboarding while reducing fraud losses and compliance risks.

Faster onboarding isn’t just an operational win — it’s a better borrower experience that drives approvals and revenue.

With Flinks, you don’t have to choose between growth and security. You get both.

🚀 Product

Sun Life Financial, Canada’s 2nd largest insurer is launching a new asset management division.

The group combines MFS (their US asset manager), SLC (their alt asset manager), Aditya Birla (their stake in an Indian asset manager), Sun Life Asia, their pension risk transfer business, and the office of the chief investment officer.

Sun Life has $1.4t in AUM.

This rebranding confirms that Sun Life is much more than an insurance company.

Symcor is shrinking its open banking team due to delays in implementation and trouble signing up clients.

Symcor is owned by TD, BMO, and RBC and is best known for payment processing.

In 2023 (when open banking was intended to be implemented) they were considered a frontrunner to be Canada’s go-to open banking vendor.

EQ Bank rolled out business bank accounts.

Theylaunched in beta last year.

⚖️ Policy

The Bank of Canada called Canada’s banking system an “oligopoly”.

OSFI admitted that they could be “a little bit less conservative” and remove barriers for innovative new companies. They also added “We don’t want to have the stability of the graveyard, where everything’s safe, but nothing happens”

Net-Zero Banking Alliance, a Mark Carney founded climate pact between major banks has been dissolved.

🧑🤝🧑 Conferences

Oct 20th is the Canadian Lenders Summit.

Oct 26-29th is Money2020. Apply here to join the Canada Delegation. I’m leading it and you’ll receive a discount.

Every month I invest $250k in an early stage Canadian fintech.

Raising money? Fill out this form

Want to invest? Fill out this form

Want to get in front of 13,267 fintech decision makers? Reply to this email to become a newsletter sponsor.

Have a great week! See ya 👋

You're currently a free subscriber to Canadian Fintech. For the full experience, upgrade your subscription.