|

Canadian Fintech: we launched a product!

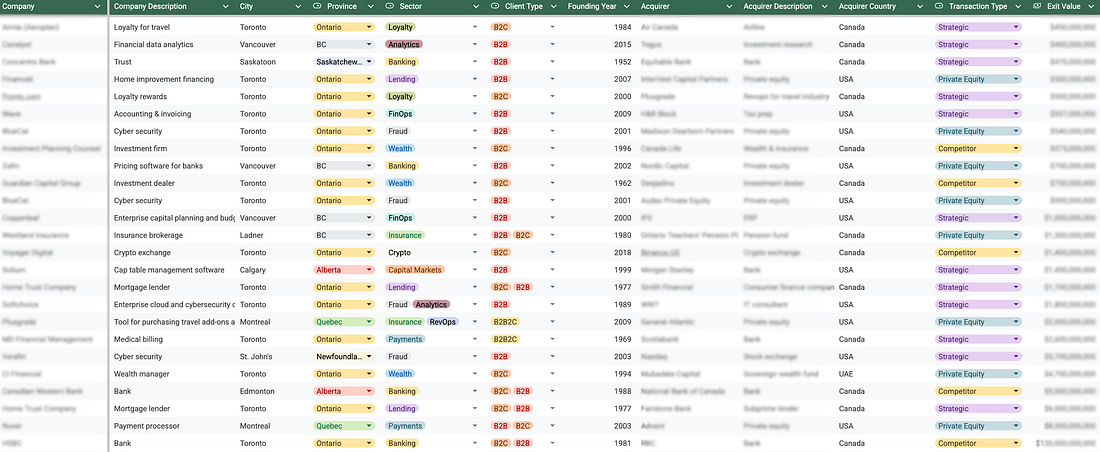

A database of every Canadian fintech acquisition compiled and tagged by me.

Good morning! Welcome back to the Canadian Fintech Newsletter, an industry roundup for founders, operators and investors.

Every Monday we break down the hottest topics in the industry in under 3 minutes.

Was this forwarded to you? Become one of our 12,489 subscribers by clicking below.

This week I’m excited to announce something new… our first product!

Introducing the Canadian Fintech Database

A list of every Canadian fintech acquisition compiled and tagged by me.

In this spreadsheet you’ll find data like:

Company names

Who acquired them

For how much

How many years it took from founding to exit

Names of founders

And more!

Why use this?

Save hundreds of hours searching for corporate information online

Get access to verified industry data from an industry insider

Quickly filter to see industry trends like: “how many years on average does it take to go from founding to exit” and “which fintech sectors had the most m&a?”

This is not a static report. I’ll be updating it every single week with new companies and insights.

How do I get access to it?

This is available exclusively to paid subscribers of the newsletter.

If you already subscribe - thank you! You now have access here.

If you’re not yet a paid subscriber, you can join for $10 / month by clicking the button below:

Whether you become a paid subscriber or not, you’ll still keep receiving our free Monday newsletter.

Thanks to everyone who encouraged me to put this together! Let me know what you’d like to see next!

Now here’s your Monday newsletter…

🤝 M&A

Three BC credit unions are merging to form Canada’s largest. Coast Capital (federal), Pospera (provincial) & Sunshine Coast (provincial) together will have $39b in AUM, 2.5k employees, 70 branches and 730k members. This transaction plays into two industry trends as CUs compete with banks:

1. CUs are expanding from Provincial to Federal coverage: thanks to changes in the Bank Act in 2012, several CUs have made the switch (Coast Capital, UNI, Innovation Federal) and last year the first inter-provincial CU merger was approved.

2. The industry is consolidating - the number of CUs has more than halved in the last 20 years. 5 major mergers were announced across BC, Ontario and the Prairies in the last year.

Kensington Capital, a Toronto based private equity and fund of funds firm acquired One9, a national defense tech VC firm.

Kensington itself was acquired by AGM, a public equities fund for $45m last year.

🚀 Product

Questrade entered the 3rd and final stage of its banking license. The fintech started their application in 2019.

Crypto is receiving blessings from the Ontario Securities Exchange (OSC):

Float launched low fee FX conversion.

Mako Fintech, a Toronto based KYC provider for the wealth industry partnered with SGGG, one of the largest Canada based fund administrators.

Raising money for your fintech? Fill out this form

Want to invest in Canadian fintech? Fill out this form

Want to get in front of 12,489fintech decision makers? Reply to this email to become a sponsor.

Have a great week! See ya 👋

You're currently a free subscriber to Canadian Fintech. For the full experience, upgrade your subscription.