|

Canadian Fintech: More Stablecoin Funding 🤑

FlipGive Acquired. Mark Leonard steps down. BC credit unions merge.

Good morning! Welcome back to the Canadian Fintech Newsletter, an industry roundup for founders, operators and investors.

Every Monday we break down the hottest topics in the industry in under 3 minutes.

If you’re a paid subscriber, you also get access to the Canadian Fintech Database - a detailed list of every fintech acquisition in Canada.

Was this forwarded to you? Become one of our 13,224 subscribers by clicking below.

💰 Funding

Tilt, a tool to create your own direct stock market indexes, raised USD $7m from Portage, Golden, & Real Ventures.

The company is founded by Andrew Peek, a Toronto founder now based in NYC. Peek also is the founder of Delphia, an algorithmic trading platform that raised $60m in 2022.

Stablecorp, the issuer of Canadian dollar stablecoin QCAD raised $5m led by FTP Partners.

Earlier this month, competitor Tetra raised $10m to launch their own CAD stablecoin.

Stablecorp is backed by several international crypto platforms including Coinbase (exchange) & DeFi Technologies (asset manager).

A slate of freshman VCs just closed their inaugural funds:

Telegraph, a spin off of European fund Telegraph Hill Capital closed Fund 1 to back Quebec based AI companies.

Simple Ventures, a venture studio backed by Canadian entrepreneurs (including the namesake founder of Wealthsimple) closed Fund 1.

North Exit Ventures, a fintech fund backed by Canadian exited entrepreneurs (and run by yours truly) closed Fund 1.

🤝 M&A

FlipGive, a Toronto based cash-back card for fundraising campaigns was acquired by US based RaiseRight, an online fundraising platform.

FlipGive raised $5m in 2023 from BDC and Framework Ventures.

Sagard, the Canadian alternative asset manager with large domestic fintech holdings, acquired Swiss investment manager Unigestion’s private equity business.

Manulife’s wealth and asset management division is acquiring UK asset manager Schroder’s Indonesian business. has agreed to buy U.K. asset manager Schroders’ business in Indonesia.

Vancouver City Savings Credit Union and First Credit Union have received approval from BC regulars to merge.

RBC says that it’s looking to hop on the m&a train and acquire a large US based wealth manager.

A MESSAGE FROM FLINKS

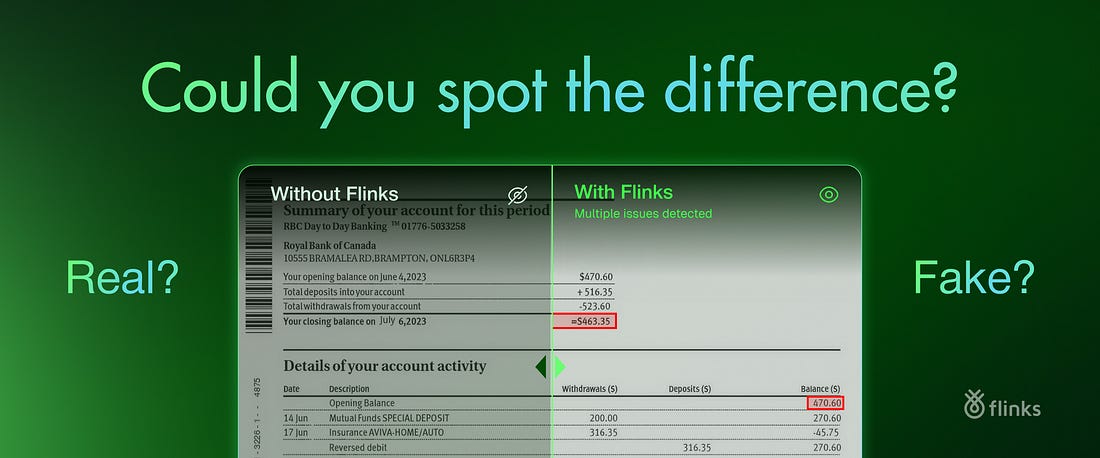

Fraud or Not? Flinks Knows.

Document fraud is a $2.8B problem for lenders, and it’s getting worse. Fraudsters now use AI and template farms to forge documents that are so realistic that 95% of professionals miss them.

Manual reviews can’t keep up. Flinks Upload, powered by Resistant AI and trained on 100M+ documents, detects up to 3× more fraud than the human eye. With 99.9% accuracy, you’ll know in seconds whether a document is authentic, modified, or fake.

The result: faster approvals, lower acquisition costs, and stronger defenses against fraud. Where others guess, Flinks knows instantly.

🚀 Product

Flybits, a Toronto based bank infra company launched an “agentic banking” product.

Think of it as a chat-style assistant that can pull together cards, loans, deposits, insurance, etc., in one convo, rather than sending customers into different app sections.

BMO is considering selling off some of its US branches with about $6b in deposits.

National Bank’s investment funds management division crossed $100b in AUM.

Alternative Payments, a US based b2b payments company expanded into Canada.

TREB, the real estate board of Toronto launched tenant credit, income, employment, rental history, background checks through a partnership with Toronto based Cove.

⚖️ Policy

FINTRAC hit KuCoin, a crypto firm with a $19.6m fine, its biggest ever.

FINTRAC raised its max fine limit to $20m last year.

KuCoin also paid a $2.1m fine to the OSC in 2023 for operating without a license.

🧍People

Mark Leonard, the legendary founder of Constellation Software, a niche software private equity firm is stepping down as President for health reasons.

Every month I invest $250k in an early stage Canadian fintech.

Raising money? Fill out this form

Want to invest? Fill out this form

Want to get in front of 13,224 fintech decision makers? Reply to this email to become a sponsor.

Have a great week! See ya 👋

You're currently a free subscriber to Canadian Fintech. For the full experience, upgrade your subscription.