|

Canadian Fintech: Shopify Expands Payments 🌎

Tetra Trust's majority investment. PayTic's Seed Extension. Polymarket crack down.

Good morning! Welcome back to the Canadian Fintech Newsletter, an industry roundup for founders, operators and investors.

Every Monday we break down the hottest topics in the industry in under 3 minutes.

If you’re a paid subscriber, you also get access to the Canadian Fintech Database - a detailed list of every fintech acquisition in Canada.

Was this forwarded to you? Become one of our 12,580 subscribers by clicking below.

💰 Funding

PayTic, a PEI based payment software for card issuers raised USD $4m led by AfricInvest.

PayTic raised CAD $3m in 2022 at the same valuation from Canadian firms Build Ventures & Concrete Ventures.

Tailscale, a Toronto based security software that lets developers set up corporate VPNs raised USD $160m at a $1.5 billion valuation.

Glowtify, a Montreal based marketing analytics software for small e-com sellers raised $825k.

🤝 M&A

Tetra Trust, a Calgary based crypto custodian received a majority investment from Urbana Corporation, a TSX listed investment firm.

Three Saskatchewan based credit unions are merging - Conexus, Cornerstone and Synergy.

Last week three BC based credit unions also announced a merger - Coast Capital, Prospera and Sunshine.

🚀 Product

Balance, a Calgary based crypto custodian launched a settlement product allowing clients to move crypto between each other instantly, without blockchain fees or delays.

Dimedove, an AI wealth advice platform soft launched.

Neighbourhood Holdings, a Vancouver based alternative mortgage lender crossed $2b in funded volume.

Minerva, an AML screening tool integrated into Paays, a digital ID platform for auto lenders. Both fintechs are Toronto based.

Shopify is expanding their payment products internationally:

A MESSAGE FROM THE CANADIAN FINANCE SUMMIT

Early Bird Tickets are on sale for Canada’s largest fintech conference! Here’s what you can expect 👇

1,000 attendees

Executives from every Canadian bank

Hundreds of late stage fintech founders

+1,000 meetings scheduled

⚖️ Policy

The Competition Bureau launched an antitrust investigation into Express Scripts, Canada’s largest pharmacy benefits manager.

The company sits between Canadian doctors, pharmacies and patients to process prescriptions and collect payment. The probe suggests that Express Scripts pushed patients to get medications through pharmacies that they own, instead of competing ones.

Manulife axed an exclusivity deal with Loblaws pharmacies last year, after catching flak for similar competition concerns.

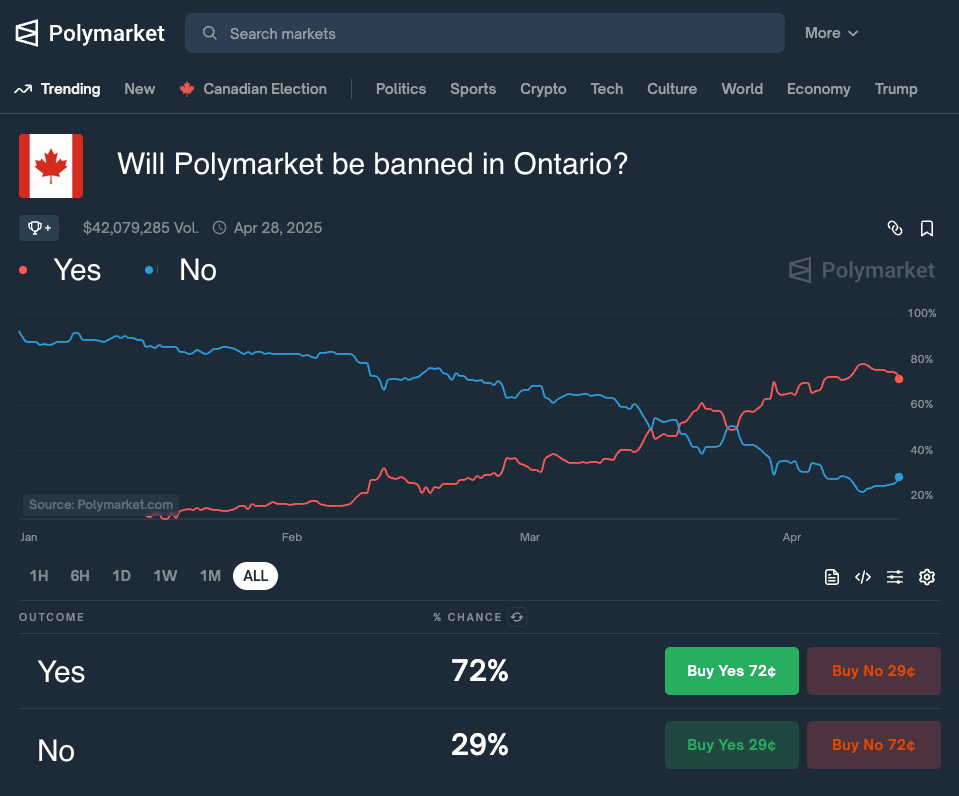

The OSC is coming down on Polymarket, a US based platform that allows people to bet on real-world events like “will Carney win the federal election?” or “will the Bank of Canada drop rates?”.

The OSC claims that Polymarket constitutes binary options trading, a financial instrument banned in Ontario since 2017.

Raising money for your fintech? Fill out this form

Want to invest in Canadian fintech? Fill out this form

Want to get in front of 12,580 fintech decision makers? Reply to this email to become a sponsor.

Have a great week! See ya 👋

You're currently a free subscriber to Canadian Fintech. For the full experience, upgrade your subscription.