|

One of the key challenges of credit card programs is that you have to both entice a prospective cardholder to apply and the program has to approve that person based on their creditworthiness. The approval challenge means acquiring a credit cardholder is much harder than most other products. If you are selling a consumer a pair of shoes or a business a software tool, you only have to convince them to buy the product or service; you don’t reject them from being able to buy it after you check their financial background. With this in mind, today’s deep dive is all about the application process, examples of known approval funnels and rates for well-known cards, and the implications for folks running card programs. The Application ProcessWhen a consumer applies for a credit card in the U.S., the application goes through multiple risk-management stages before a final approval or denial. These stages generally include: - Identity verification, know-your-customer (KYC), and customer identification program (CIP) compliance

- Fraud screening

- Credit underwriting (creditworthiness assessment)

Each stage can result in some applications being filtered out. Recent industry data sheds light on typical approval or rejection rates at each stage and trends in how major card issuers handle this process. While the identity and KYC verification stage typically has a pass rate well above 90%, fraud screening filters out a few additional percent of applications, and ultimately, only around 40–50% of all credit card applications result in approval (this number varies a lot by issuer and card product). Trends in Approval RatesIn the past 1–2 years, issuers have tightened underwriting somewhat as credit conditions normalize post-pandemic. The New York Fed reported that the rejection rate for credit card applicants rose to ~19.6% in 2023 (from ~18.5% in 2022), the highest in about five years, even as application volumes fell. In other words, fewer people are applying, and a slightly larger fraction are denied, reflecting cautious credit policies. Nonetheless, overall access to credit cards remains high compared to the 2020 downturn, as many issuers had loosened standards in 2021–22 before the recent slight uptick in denials. Credit Underwriting is CrucialThe final and most consequential stage of the whole approval process is credit underwriting: evaluating the applicant’s creditworthiness and deciding whether to approve the card and on what terms. Approval rate data from the CFPB’s Consumer Credit Card Market Report implies that roughly half of all applications are denied for credit reasons. Underwriting relies on the applicant’s credit bureau report and score, income, and debt obligations, as well as the issuer’s internal risk models. Common reasons for denial at this stage include: credit score too low, high existing debt or delinquencies, insufficient income, limited credit history, or too many recent credit accounts opened. Credit approvals vary enormously by the applicant’s credit tier: - Prime and Super-Prime applicants (good/excellent credit): Most of these applications are approved. Data show that consumers with FICO scores in the high 700s or 800+ have an 80–90% approval rate at major banks.

- Near-Prime applicants (fair credit): This middle segment (e.g., FICO in the 600s) might see approval rates around the 40–60% range. CFPB data indicates ~41–44% approval for near-prime consumers on general cards in 2022, but retail cards approved over 60% of near-prime applications (as some retailers intentionally extend credit to slightly riskier customers).

- Subprime and Deep Subprime (poor credit): Approval rates plummet here. CFPB reported that under 20% of subprime (<620 FICO) applications were approved for general-purpose cards. Even store cards approved only ~10–13% of deep subprime applications in 2022. Many issuers do not offer unsecured cards to consumers below a specific credit score (instead steering them to secured cards or other products).

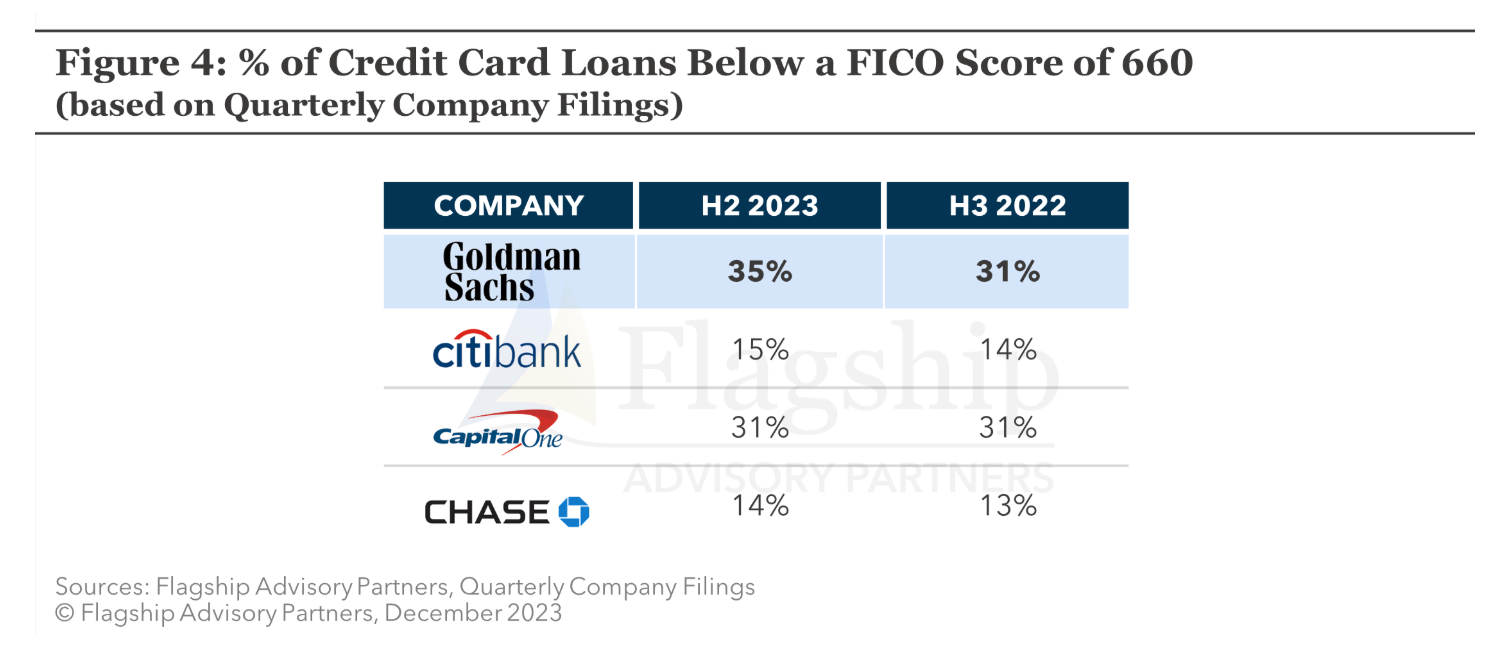

It’s also worth noting that the application channel plays a role. Pre-screened credit card offers (where a consumer receives a targeted mail/email and responds) have the highest approval rates (often 70% or higher) because those applicants were pre-selected based on credit data. In-person and mail applications also see relatively higher approvals (~60%). Meanwhile, fully unsolicited online applications (e.g., applying cold via a website or mobile app) have lower average approval rates (one report by the CFPB found mobile and third-party website applications had only ~38% approval, a few points below the overall average). This is likely because online channels get a broader mix of applicants (including more marginal ones), whereas pre-approved solicitations target those most likely to qualify. Underwriting standards tend to tighten or loosen with the credit cycle. During the pandemic in 2020, issuers pulled back and approval rates dropped sharply (general card approvals hit ~36% in 2020). In 2021 and 2022, standards loosened again, and approvals climbed (back to mid-40%) amid a competitive push for new customers. By late 2022 into 2023, there were signs of selective tightening: for example, the Fed’s survey in October 2023 showed higher rejection rates and consumers reporting it was harder to get credit. Rising interest rates and higher card delinquencies in 2023 made banks more cautious. Even so, the overall availability of credit cards remained robust by historical standards: application and approval rates in 2023 were still above pre-2019 levels for many segments. Essentially, issuers became more discerning about who they approve and the credit lines they grant, focusing on credit quality due to concerns about consumers’ debt loads and ability to pay in a high-inflation environment. One noteworthy development is the growing use of “soft pull” pre-approvals in the application process. An increasing number of issuers now let consumers see if they are likely to be approved (or even get an approval decision) with a soft credit inquiry, before a hard inquiry and formal account opening. This trend, led by Apple Card’s instant application in 2019, has been adopted by others. In late 2022, American Express launched a feature to tell applicants if they’re approved with no impact on credit score (only finalizing with a hard pull if they accept). Discover, Capital One, and various fintechs similarly use soft-pull preapproval workflows. This doesn’t change underwriting criteria, but it improves the consumer experience and likely increases application volume (since consumers can “try” without dinging their score). It may also mean that formal denial rates (after hard inquiry) appear lower because some unqualified applicants never proceed past the soft-check stage. From the issuer’s perspective, though, the credit risk thresholds remain the same; they are simply filtering in a friendlier way. Overall, credit underwriting remains the make-or-break stage for most applications. About half (or more) of all would-be cardholders ultimately do not pass this hurdle due to credit risk. Those who are approved typically have higher credit scores, stable finances, and meet whatever internal rules each issuer imposes. Underwriting Policies Vary Across the IndustryApple Card was launched in 2019 in partnership between Apple and Goldman Sachs as the issuing bank with a surprising underwriting approach. Apple wanted broad adoption, so Goldman Sachs extended credit to a wider swath of customers than some prime issuers. The Apple Card has no annual fee and was marketed to be widely accessible. Apple even introduced a “Path to Apple Card” program to help borderline applicants improve their finances and get approved later.  The most accessible expensive metal card The result: Goldman’s underwriting for Apple Card has been relatively inclusive (some may even say aggressive) by industry standards. Notably, Goldman set the minimum FICO score for approval quite low. Apple’s disclosures say a FICO Score below ~600 will likely result in denial. In practice, many Apple Card users have credit scores in the 600s, not just 700+ prime. By late 2022, more than 25% of Goldman’s Apple Card loan balances were held by customers with FICO scores below 660, and by Q3 2023, that share had risen to 35%. This is significantly higher risk exposure than other major card issuers. For comparison, at the same time, only ~13–15% of Chase and Citi’s card portfolios were sub-660, and Capital One (known for serving subprime) was about 31%.  One consumer survey by the NY Fed implied co-branded cards (like Apple Card) had high acceptance among applicants, but we can use Goldman’s portfolio data as a proxy: the bank accumulated about 15 million Apple Card accounts by 2023 in just four years, penetrating an estimated ~18% of Apple’s eligible customer base. This rapid growth suggests a substantial number of approvals. However, the flipside of lenient underwriting has been higher delinquencies – Goldman’s net loss rate on credit cards hit 3.5% in 2022 (double that of issuers like Chase at ~1.5%) and climbed to over 6% by late 2023, driven largely by the weaker credit segment they approved. Goldman and Apple have reportedly re-evaluated some of these strategies, especially as Goldman is looking to pull back or transfer the Apple Card portfolio (it announced plans in 2023 to exit the partnership). I always thought the Apple Card strategy was quite wild. Goldman has issued credit lines as low as $250 and as high as $50,000. The bank has lost quite a bit of money on this program, although cardholders seem quite happy. As economic conditions tighten, Goldman has likely become more selective (some users noted it became harder to get approved or get credit line increases in 2023 compared to 2019). However, the Apple Card remains one of the more accessible rewards cards. If you meet the basic requirements and don’t have major negatives, your approval odds are fairly good. Goldman will decline those with recent delinquencies, heavy debt, or very low scores (per Apple’s criteria list), but a FICO of ~600+ with decent income stands a chance. This is in contrast to our next example, American Express, which traditionally requires higher credit standings. Underwriting is where Amex is comparatively strict. While I was at Bankrate, we saw Amex, amongst all issuers, consistently had the lowest approval rate per click sent to an application page. One part is selectivity, one part is that consumers broadly prefer Visa or Mastercard products, and one part is that other issuers have more alternative options to offer to users than Amex. (For example, you might apply for a Platinum and Amex won’t approve you for that or a Green Card, whereas you might apply for a Chase Sapphire and Chase could say “no, but would you like a Freedom?”) One interesting metric: the CFPB data by credit tier implies that for super-prime applicants (800+ FICO), approval rates are around 90%. Many Amex applicants fall in that range, so they sail through. For moderate scores (~660–680), Amex might approve some (especially if income is high or they have a prior relationship), but could deny others, contributing to the notion that Amex has a somewhat lower overall approval rate than mass-market issuers. Without hard numbers, we can say American Express approves most applicants with good credit, but likely rejects most applicants with fair/poor credit. They also sometimes limit credit extension. For example, if you already have many Amex cards or loans, they might decline new accounts or suggest product changes instead.  More expensive and harder to get these metal cards In terms of trends, Amex appears to be maintaining a steady credit posture. They didn’t dive into subprime during the recent fintech wave, and thus didn’t have to pull back the way some others (Goldman, Capital One) did. They did join the soft-pull preapproval trend, which suggests their funnel might see fewer outright denials. Also, Amex often uses existing customer upsell – a huge portion of their new cards each year are issued to current Amex cardholders who are very likely to be approved for additional products. This pushes their effective approval rate up, since if you already have an Amex and have managed it well, the company is inclined to approve you again. KYC/fraud frictions are low with Amex, and underwriting is geared toward prime credit. Your chances are quite good if you meet their standards (say FICO 700+, low debt, no recent blemishes). If you’re borderline, Amex will probably err on the side of caution and decline, but might invite you to apply again or offer a different card. Amex’s reputation as a prestigious card issuer comes from this deliberate curation of clientele. One interesting credit-risk related policy is employed by Chase: “the 5/24 rule.” This Chase policy automatically declines a credit card application if the applicant has opened five or more credit cards in the last 24 months. This isn’t a traditional fraud flag (it’s more to curb “credit churning” and possibly risk stacking), but it functions as a hard cut-off in Chase’s decisioning. From the perspective of an applicant, even if you have excellent credit, if you’ve opened a bunch of accounts recently, a Sapphire application will be instantly rejected. They view multiple recent accounts as a risk factor, either for gaming rewards or indicating financial stress, and willingly deny a significant number of otherwise qualified applicants for policy reasons. Industry experts and crowdsourced data have confirmed that this rule affects Chase approvals widely. No other major issuer has an explicit policy as well-known as this, which likely makes Chase’s overall approval rate for cards like Sapphire a bit lower than it could be, because a chunk of applications are auto-denied due to 5/24.  RIP old CSR design. Also expensive and hard to get Anecdotally, Chase is known to sometimes initially deny and then approve on reconsideration if the applicant calls and clarifies information or moves credit around fromanother card. This suggests borderline cases can be resolved in favor of approval, meaning Chase’s process isn’t designed to maximize outright denials – it’s designed to strictly enforce certain criteria. I’ve personally had success with this in a few cases: once when my overall credit exposure to Chase got quite high (as a result of applying for a fourth card), but a call to reconsideration and offer to take some of my credit limit from an existing card and shift it to another card helped. When I started Totavi, I had to speak to reconsideration to get my first card because my business was new. What does this mean for aspiring card issuers?Approval rates at each stage of a credit card application follow a funnel: nearly all applicants pass identity/KYC checks, a small percentage are filtered out by fraud prevention, and roughly 40–50% end up approved after credit underwriting (with higher or lower odds depending on one’s credit strength). KYC and fraud processes have been bolstered by technology, yielding high pass rates (90%+ automated identity verification success and only ~5% or less of applications flagged as fraud), while fraud itself is evolving (synthetic IDs are on the rise). Prospective issuers can take the lessons learned by these major issuers when creating their own application funnel. How can technology help encourage inclusive underwriting in a way that offsets losses? Are there proprietary policies that can help filter customers you do (or do not) want? Who is your target customer and how can your funnel ensure they get your card? Further Reading- “Consumers Expect Further Decline in Credit Applications and Rise in Rejection Rates - FEDERAL RESERVE BANK of NEW YORK.” www.newyorkfed.org, www.newyorkfed.org/newsevents/news/research/2023/20231120.

- The Consumer Credit Card Market. CONSUMER FINANCIAL PROTECTION BUREAU, Oct. 2023. https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2023.pdf.

- “How Digital Identity Verification Works: 8 Vital Data Checks.” Plaid, plaid.com/resources/identity/digital-identity-verification/.

- “How the Bilt Mastercard Increased Its Onboarding Pass Rate to 90%+ with Prove Pre-Fill.” Prove.com, 2022, www.prove.com/blog/how-the-bilt-mastercard-increased-its-onboarding-pass-rate-to-over-90-percent-with-prove-pre-fill.

- TransUnion. “TransUnion Report Indicates Suspected Digital Fraud in Nearly 14% of All Newly Created Global Digital Accounts in 2023.” GlobeNewswire News Room, TransUnion, 21 Mar. 2024, www.globenewswire.com/news-release/2024/03/21/2850186/0/en/TransUnion-Report-Indicates-Suspected-Digital-Fraud-in-Nearly-14-of-All-Newly-Created-Global-Digital-Accounts-in-2023.html.

- “Are Your Customers Real? Synthetic Identities Are Driving Fraud.” Transunion.com, 2025, www.transunion.com/blog/are-your-customers-real-synthetic-identities-driving-fraud.

- Howell, Erik, and Claire Hoffman. “The Rise and Fall of the Apple-Goldman Sachs Consumer Finance Partnership.” Insights.flagshipadvisorypartners.com, 14 Dec. 2023, insights.flagshipadvisorypartners.com/the-rise-and-fall-of-the-apple-goldman-sachs-consumer-finance-partnership.

CardsFTW

CardsFTW, released weekly on Wednesdays, offers insights and analysis on new credit and debit card industry products for consumers and providers. CardsFTW is authored and published by Matthew Goldman and the team at Totavi, a boutique consulting firm specializing in fintech product management & marketing. We bring real operational experience that varies from the earliest days of a startup to high-growth phases and public company leadership. Visit www.totavi.com to learn more. Interested in reaching our audience? You can sponsor CardsFTW.

|